Fixed Pay Vs Variable Pay – GD/WAT Topic

FIXED PAY VS VARIABLE PAY

Have you ever noticed that your monthly salary credited to your bank account is less than the actual CTC mentioned in your offer letter? Yes? Well, Then this is so because of the structure of salary and the tax implications imposed on it. Though salary document is not one of the easiest financial documents to decipher there is no rocket science behind it. Let’s explore more about Fixed Pay vs Variable Pay.

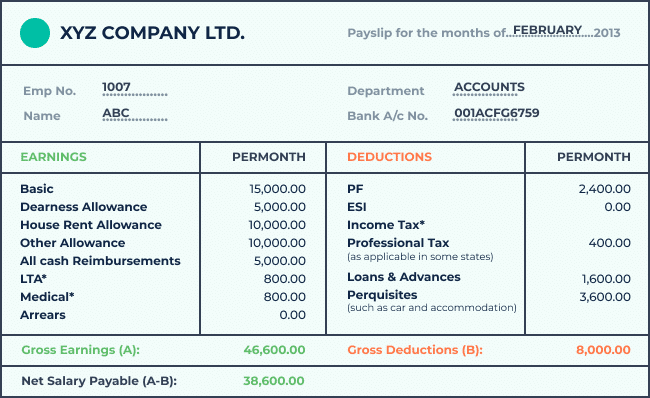

There are generally two components of your salary viz, Earnings and Deductions. Earnings consist of various parts like Basic Pay, House Rent Allowance, Start Bonus, Shift Allowance, Medical Allowance, Variable Pay, etc. whereas deductions include Provident Fund and Professional Tax towards the government.

Net Pay=Total Earnings + Gross Deductions.

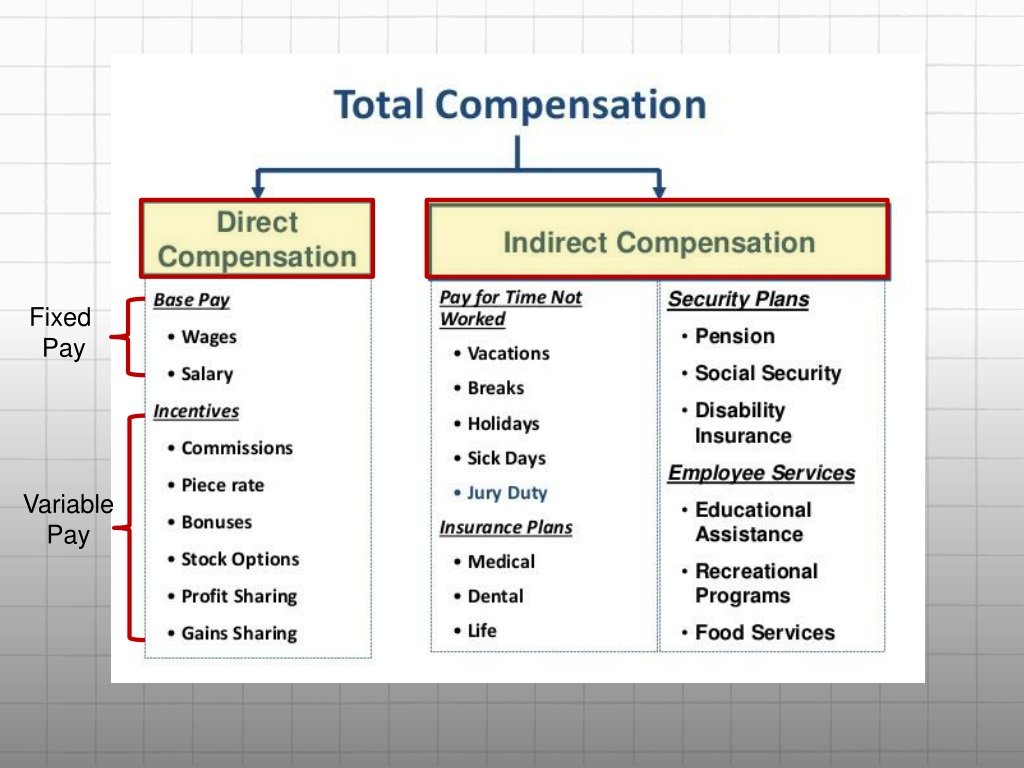

Let us take a brief overview of what Fixed Pay and Variable Pay mean.

Fixed Pay is predefined and fixed and you will get the same salary which has been mentioned in the offer letter. You will get fixed pay at the end of every month whereas Variable pay, as the name suggests is variable. You will get Variable Pay once in a quarter or half yearly which may differ from an organization to organization.

QUOTE

“Salary negotiations shouldn’t be limited to just salary. Salary pays your mortgage, but terms build your career.” –Christopher Voss

“If to love each other is the job, then the happy life is the salary.” –Toba Beta

STATISTICS – What Numbers have to Say?

- The ratio of fixed pay to variable pay generally depends upon the level of responsibility of an employee within an organization and the role he plays. Generally, it has been observed that the employees engaged within the sales activities have been rewarded a larger ratio of variable pay than the ones involved in the static or execution roles.

- In the Indian conditions, for the sales profile the ratio of fixed pay to variable pay can be as much as 60:40, while in the countries like the US it could be as much 30:70

- For static or execution roles which are not involved in sales or marketing roles, most companies give 80:20 depending on the individual meeting his own objectives, whereas a role which determines the profitability of an organization or business unit in short time might give ratio as much as 60:40

DESCRIPTION – Let’s take a Deep Dive

What is Fixed Pay?

Fixed pay is fixed and guaranteed payable to the employee. Fixed Pay includes various allowances like Basic Pay, Dearness Allowances, House Rent Allowances and depending on company’s policy other components may get added as fixed components. It is payable on a monthly basis. Fixed Pay is always 100% payable in place of the employee service. It is generally linked to the minimum performance level. If the employee performs or not, the employee will surely get his fixed part.

What is Variable Pay?

Variable pay is generally a percentage component of the employee’s fixed salary that he will get on a quarterly or yearly basis depending upon the company’s norms. It includes the negotiable portion and includes performance-based or profit based remuneration. Variable pay may vary from 0% to 100% depending upon the company. It is not a guaranteed payable to the employee. Variable pay depends on the employee’s performance within the company. It is a kind of incentive offered to the employee.

Let us assume that your total package is Rs 20000/- per month. Out of which one gets 18000 as fixed pay and 2000 is the variable pay. So you will get Rs 18000 at the end of the month. Now let’s suppose your company announces the percentage of variable pay to be 80% so you will get 80% of your variable pay 2000 which is equal to 1600 Rs. So at the end of the quarter, you will get 1600*3= Rs 4800 as your variable pay.

What is CTC?

CTC stands for Cost to Company. The package announced by the company consists of this term called CTC which further has bifurcation as Fixed and Variable Salary etc.

PROS AND CONS OF FIXED PAY AND VARIABLE PAY

The following factors are considered while deciding on a payment scheme. The pros and cons of fixed pay and variable pay are listed according to the factors.

- Productivity – Productivity is generally increased by the variable pay scheme because the high performing employees are well compensated and rewarded for their efforts while underperforming employees or low performers also feel motivated in order to improve.

- Satisfaction – Employees generally feel satisfied and motivated towards their work when they are awarded variable pay schemes.

- Less Investment – Variable pay helps stick the employees towards the organization for long tenure as they have been well awarded depending upon their performance which benefits the organization, thereby less investment of the organization in new employees training them. This results in stability to the organization

- Cheating – Generally in the sales job the employees try to maximize their targets without even thinking about the end users. They may force their customers just to make huge profits so that they get a large share of variable pay. This might result in the end users being cheated by the employees, whereas in fixed pay scheme healthy relations can be maintained among the employees and the end users.

- Less Camaraderie, More Competition – Variable pays can lead to tremendous competition among the employees to reap the benefits which might even destroy their friendships and mutual trust amongst the colleagues. Whereas in the fixed pays, cordial relations are maintained among the colleagues.

CONCLUSION

Thus it can be concluded that both the payment schemes are equally important for the organization and anyone would not reap benefits for the organization as a whole. Therefore, companies should adapt according to the needs of time and take actions whenever necessary. Communication is the key to this. Communication among the employees and the organization is a must. Through fruitful communication, Organization can achieve greater heights.

Author – Vishal Malpure

Scrutiny – Mitali Shingne

Must Explore